Contingency-Fee Based Results

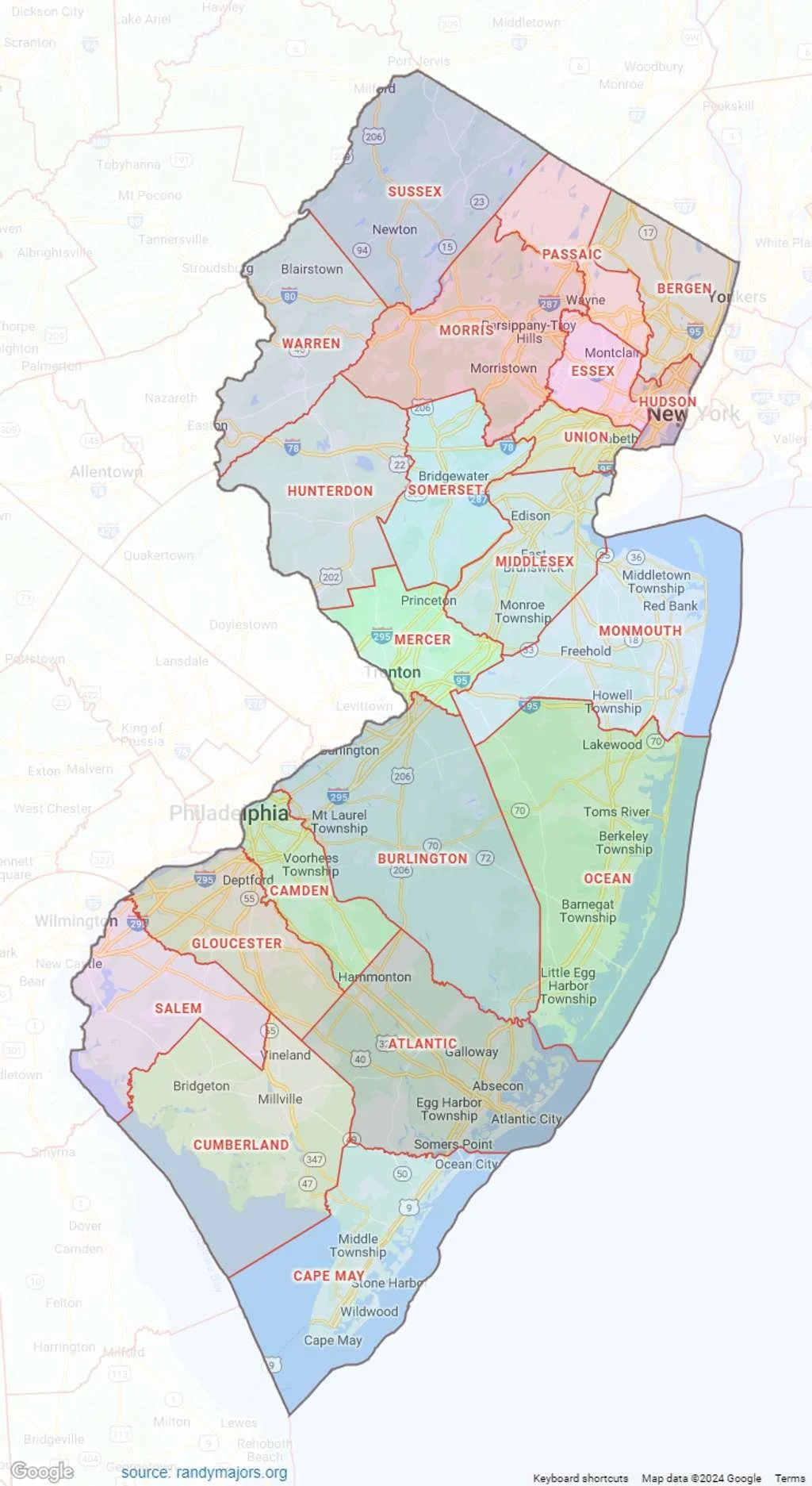

NJ Property Tax Consultants LLC. is a New Jersey-based consulting firm specializing in commercial, industrial, and high-end residential real estate. Our consultants have over 15 years of experience in New Jersey real estate consulting. Our firm is dedicated to saving property owners and tenants the maximum savings based on accurate valuations.

In today’s challenging economic climate, marked by inflation and rising property tax rates, New Jersey taxpayers face increasing financial pressures. These conditions, combined with reduced rental income, create a critical opportunity to lower your property tax obligations for the 2026 tax year and beyond.

Under Chapter 123, Laws of 1973, property owners and tenants have the right to appeal assessments, even if the assessed value seems lower than the market value. Our consultants have extensive experience, ensuring that your property’s assessment is thoroughly reviewed against municipal equalization ratios, identifying opportunities to reduce your tax burden. Many properties in New Jersey bear an unfair share of municipal taxes, making annual assessment reviews more important than ever.

Whether you own commercial properties, industrial facilities, or high-end residential estates, we are committed to helping our clients secure fair assessments and maximizing tax savings across the Garden State. We work on a contingency-only fee arrangement.

Our Property Tax Analysis Includes:

Evaluation of the Three Approaches to Value: Analyzing cost, income, and market data methods to determine the strongest position for appeal.

Assessment Review: Examining reassessments, revaluations, added assessments, and any increases in assessed value.

Market Condition Analysis: Incorporating current market trends to support assessment reduction opportunities.

Obsolescence Identification: Identifying physical, functional, or economic obsolescence that may justify a lower assessment.

Comparative Assessment Review: Reviewing assessment records for the subject property and comparable properties to ensure uniformity and accuracy.

On-Site Property Inspection: Conducting property inspections when necessary to verify key data.

Tax Savings Estimation: Estimating potential property tax savings based on appeal outcomes.